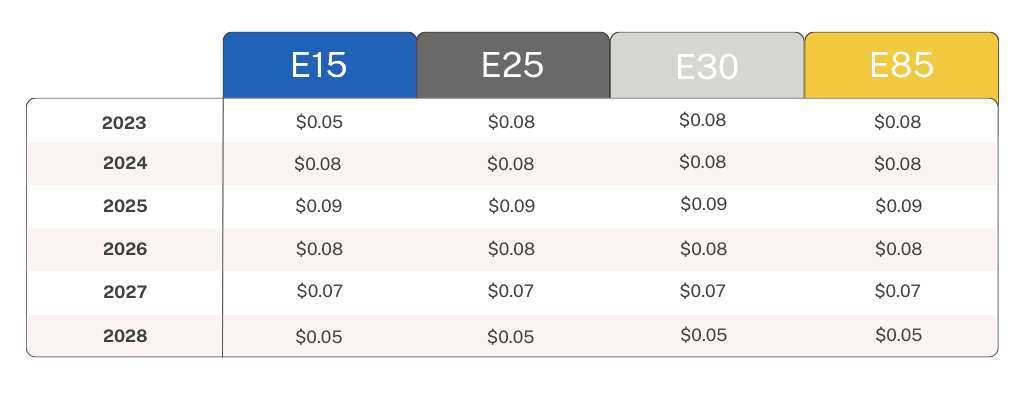

The Nebraska Higher Blend Tax Credit Act offers a meaningful tax incentive for retailers offering higher ethanol blends. You can receive a tax credit in the amount of 5 cents per gallon sold of E15 and 8 cents per gallon sold of blends containing 25% to 85% ethanol. Learn more here.

Contact

Kate Knapp

Tax Specialist Senior, Policy Section

Nebraska Department of Revenue

301 Centennial Mall South

PO Box 94818

Lincoln, NE 68509-4818

402-471-5773

kate.knapp@nebraska.gov

Forms

Nebraska Higher Blend Tax Credit Act Application

Notification of Change for Underground Storage Tanks

Find additional forms on the Nebraska Department of Revenue's website.

Application Templates